Mortality Prediction Model for Life Insurance

BUSINESS PROBLEM

- A leading life insurance company in India, with products across term, non-term, and mixed segments, maintained a sub-1% claim rate for its term portfolio.

- To improve underwriting and claims management, there was a need to build an early claims forecasting system using multi-source data—enabling proactive risk assessment and faster decision-making across all products.

SOLUTION

- Multi-Stage ML Framework to enhance decision-making across the customer journey.

Stage 1: Predict claim risk using application profile data.

Stage 2: Refined predictions using enriched data—profile, IIB, and medical information. - Void Classification Model developed to minimize future manual voids by automating identification.

- Segmented models built to address loss prediction across 1-year vs. multi-year policy durations.

- Hyperparameter optimization through iterative experimentation with diverse ML algorithms and frameworks for optimal model performance.

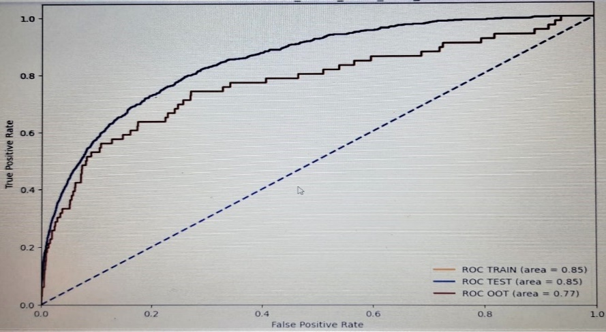

Performance measurement of Model at various thresholds - ROC curve

BENEFITS

- Risk Segmentation of Applications in the Customer Journey.

- Optimization of Due Diligence Efforts.

- Enabling instruments of differential pricing based on data and history.

- Automated underwiring to minimize human intervention, easy to scale on demand.

PERFORMANCE

Model Results

MODEL NAME | CAPTURE RATE IN TOP 5 PERCENTILE |

TERM Product 1 YEAR CLAIM | 39.53% |

TERM Product 1 YEAR VOID | 60.96% |

HYBRID Product 1 YEAR CLAIM | 42.86% |

HYBRID Product 1 YEAR VOID | 49.23% |

TERM Product 3 YEAR CLAIM | 34.63% |